Modern data governance for finance & banking

Turn complexity into clarity

Whether you’re publishing reports under BCBS 239, managing ESG metrics, or standardizing KPIs across regions, the same challenge applies: you need to know where your data comes from, who owns it, and whether it can be trusted.

- Data is siloed across retail, risk, finance, and compliance

- Metrics and definitions vary by team or entity

- Audit preparation is reactive, manual, and time-consuming

- Policies aren’t connected to operational systems

- Ownership and responsibilities are unclear

Why use DataGalaxy for the public sector?

Comply with evolving regulations (BCBS 239, GDPR, IFRS 17, ESG…)

Improve the accuracy of finance & risk reporting

Streamline audits & controls

Empower business lines with clarity

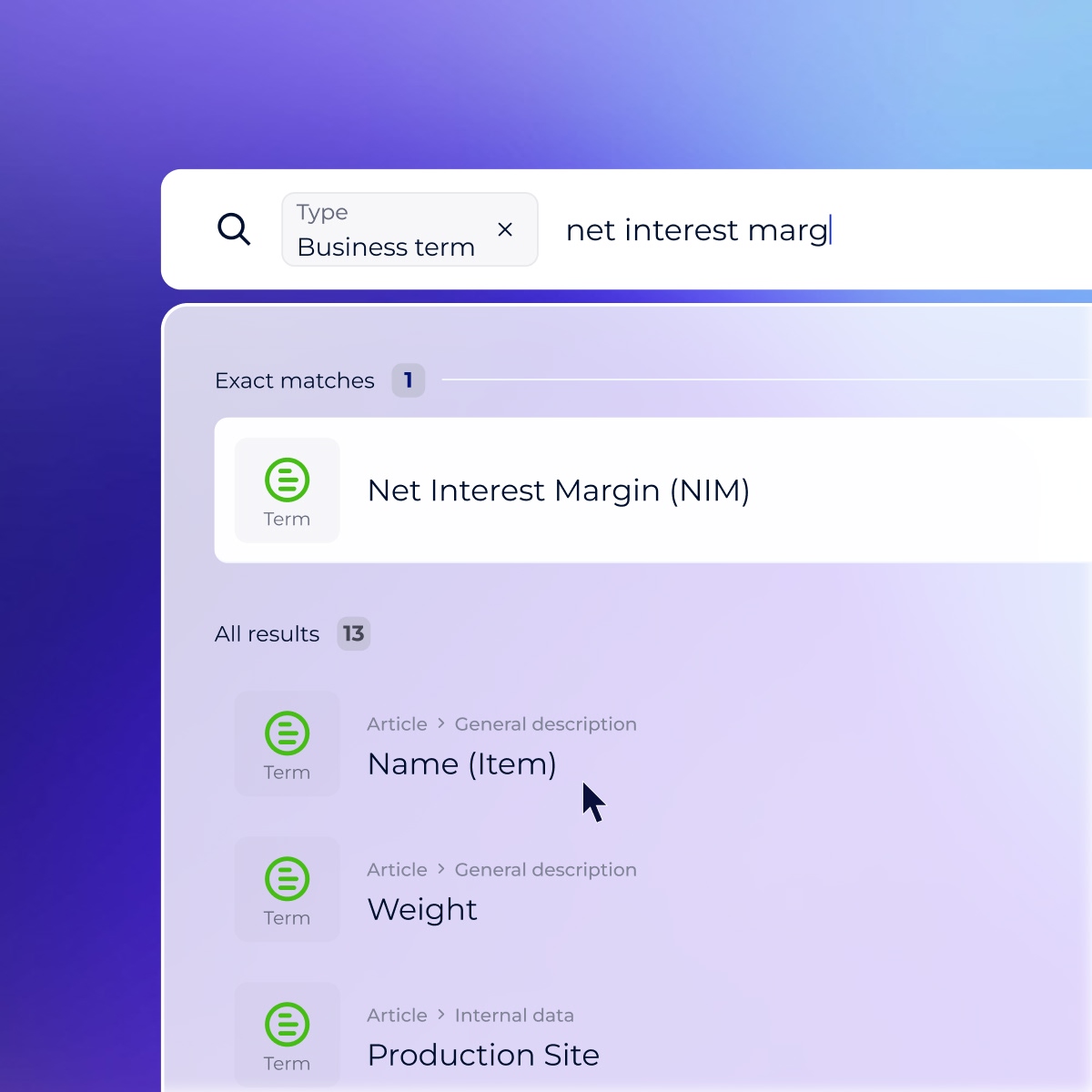

Build a unified, traceable finance data catalog

Centralize financial KPIs, reports, and controlled attributes with clear documentation and governance standards across all business units.

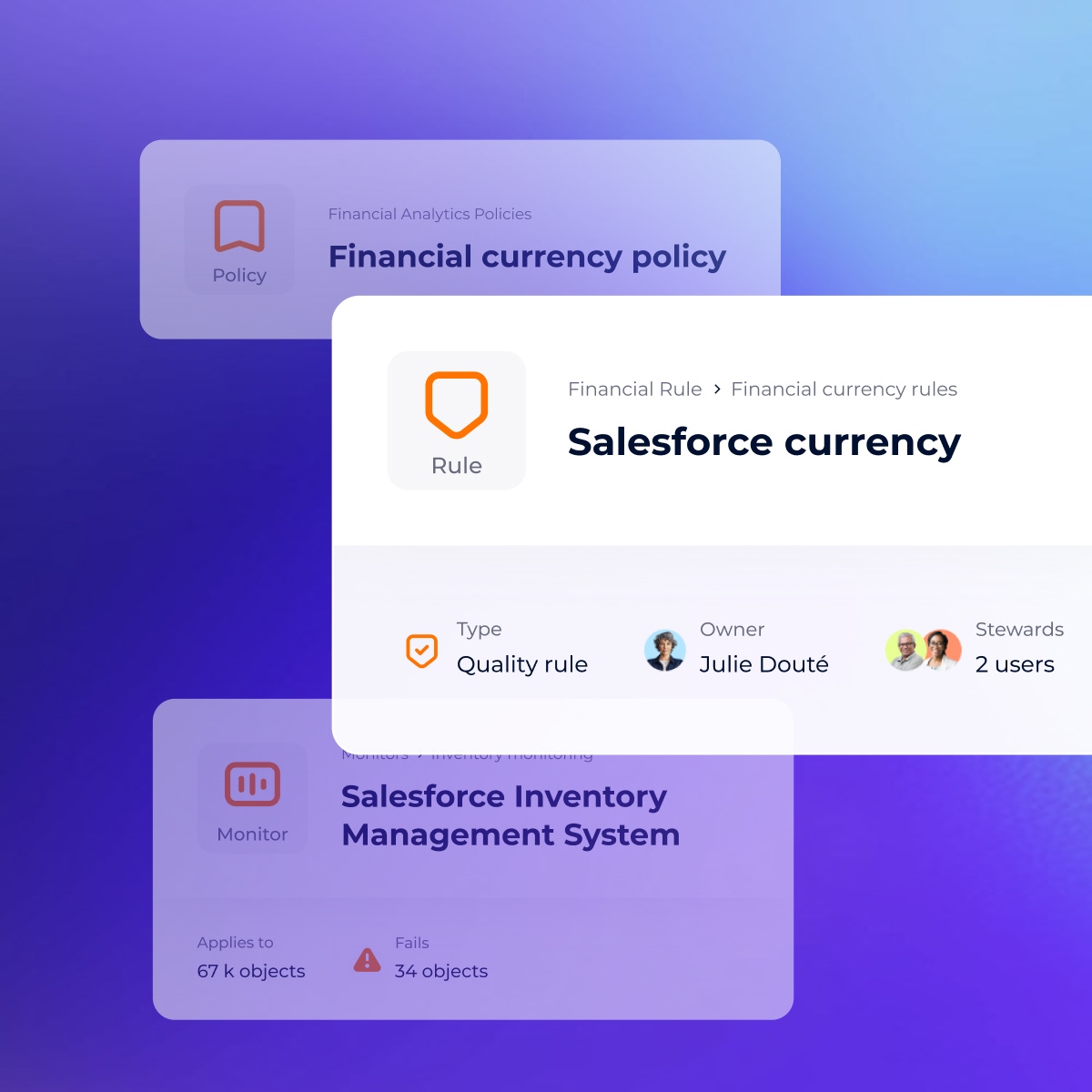

Define & manage regulatory rules

Document policies, map them to fields and reports, and monitor enforcement with automated rule tracking.

Perfect for BCBS 239, IFRS 17, ESG, or local obligations.

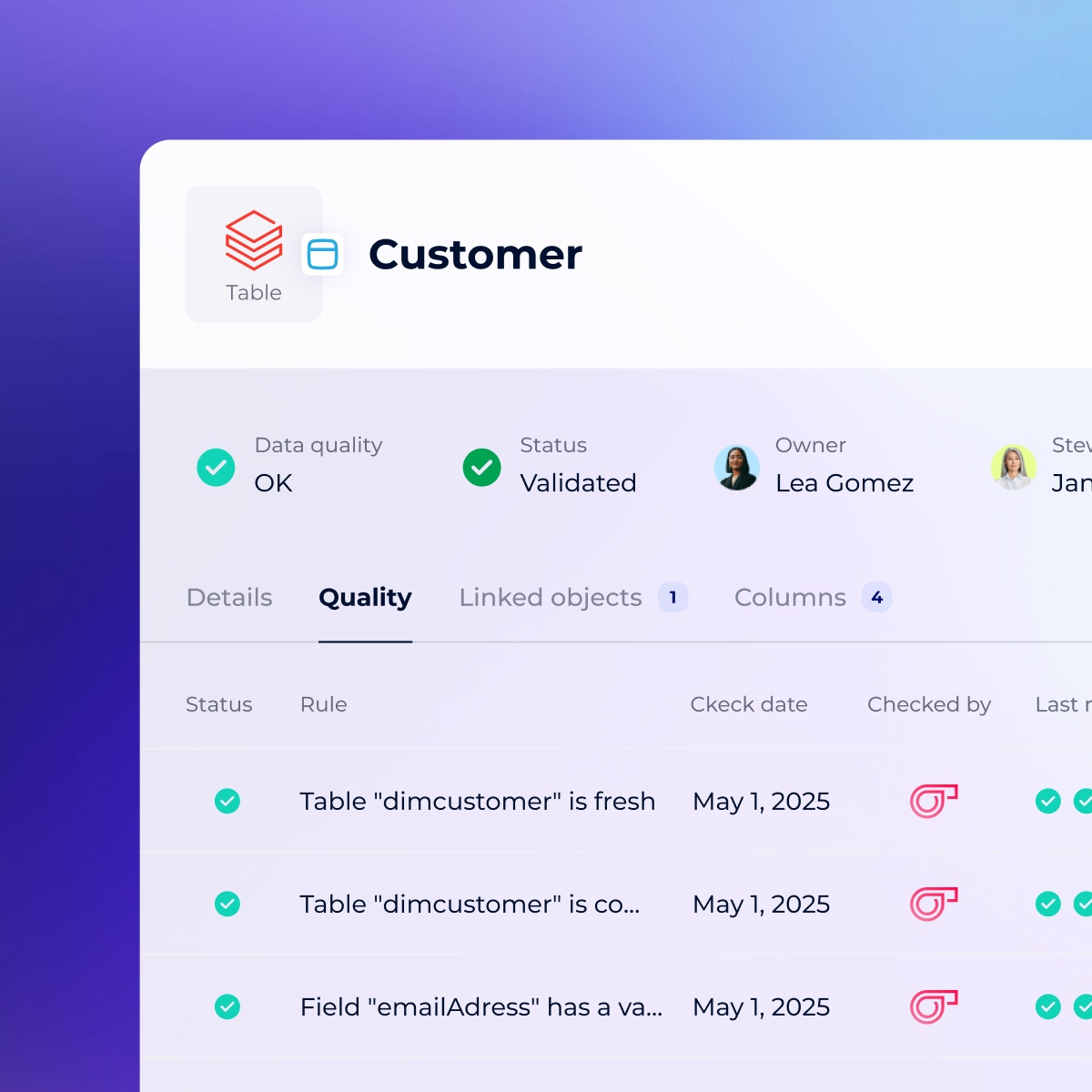

Ensure data quality meets regulatory standards

Connect your data quality tools to monitor rule enforcement, detect anomalies, and document data reliability, so you’re always audit-ready and aligned with compliance requirements.

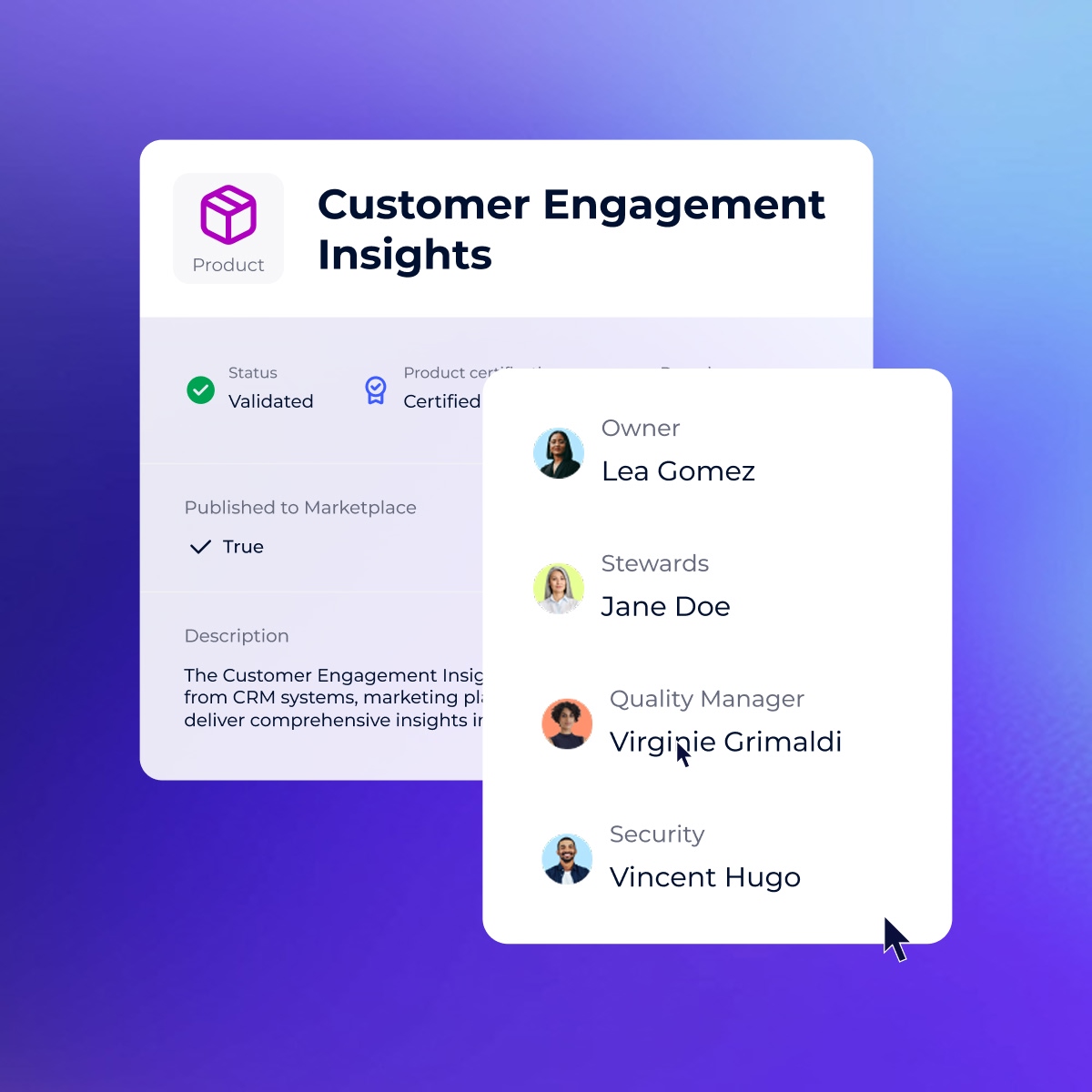

Assign clear roles for every dataset and report

From CDOs to risk analysts, ensure each asset has defined owners, reviewers, and stewards. No more gaps or delays during audits.

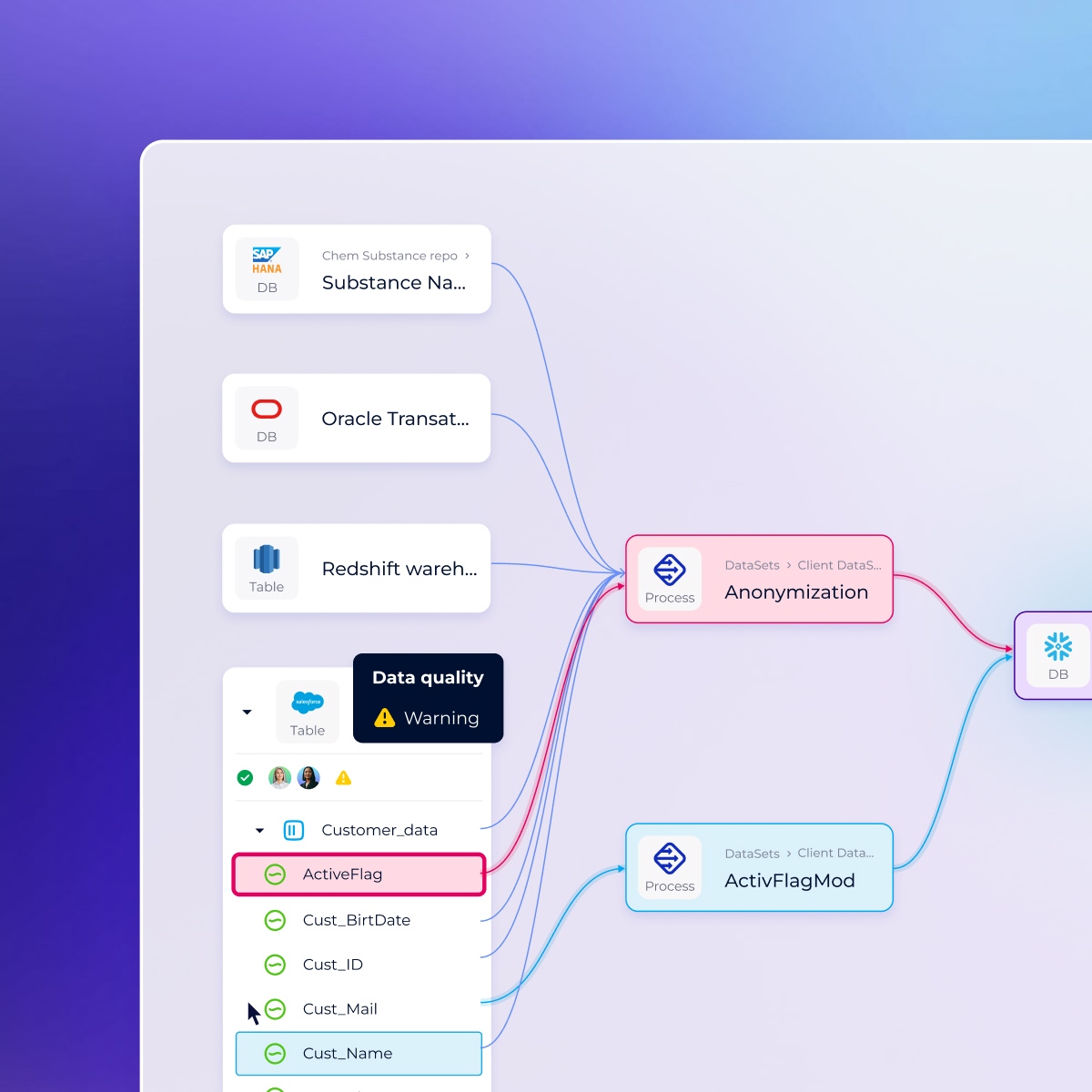

Visualize lineage from core banking systems to dashboards

Trace how data moves, transforms, and lands in finance reports — whether it flows through your DWH, MDM, or reporting stack.